Not all themes are created equally.

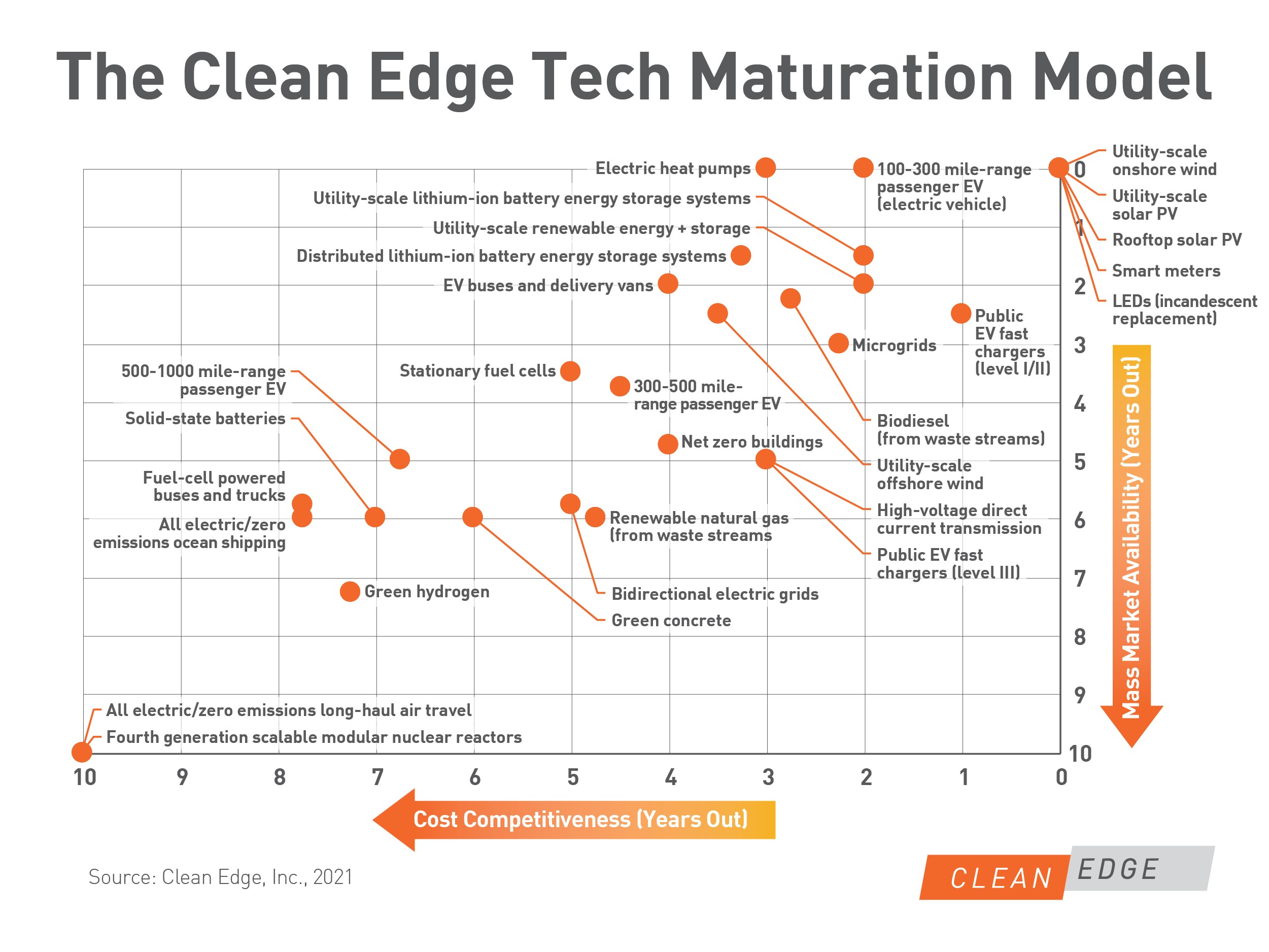

A lot of the themes we cover have sub-themes and various moving parts. Clean Energy is just one example. Predicting when specific energy sources will be come to fruition is a tricky game; Solar’s been around since the 1970’s, while we might not see Hydrogen hit the mass-market until the end of this decade.

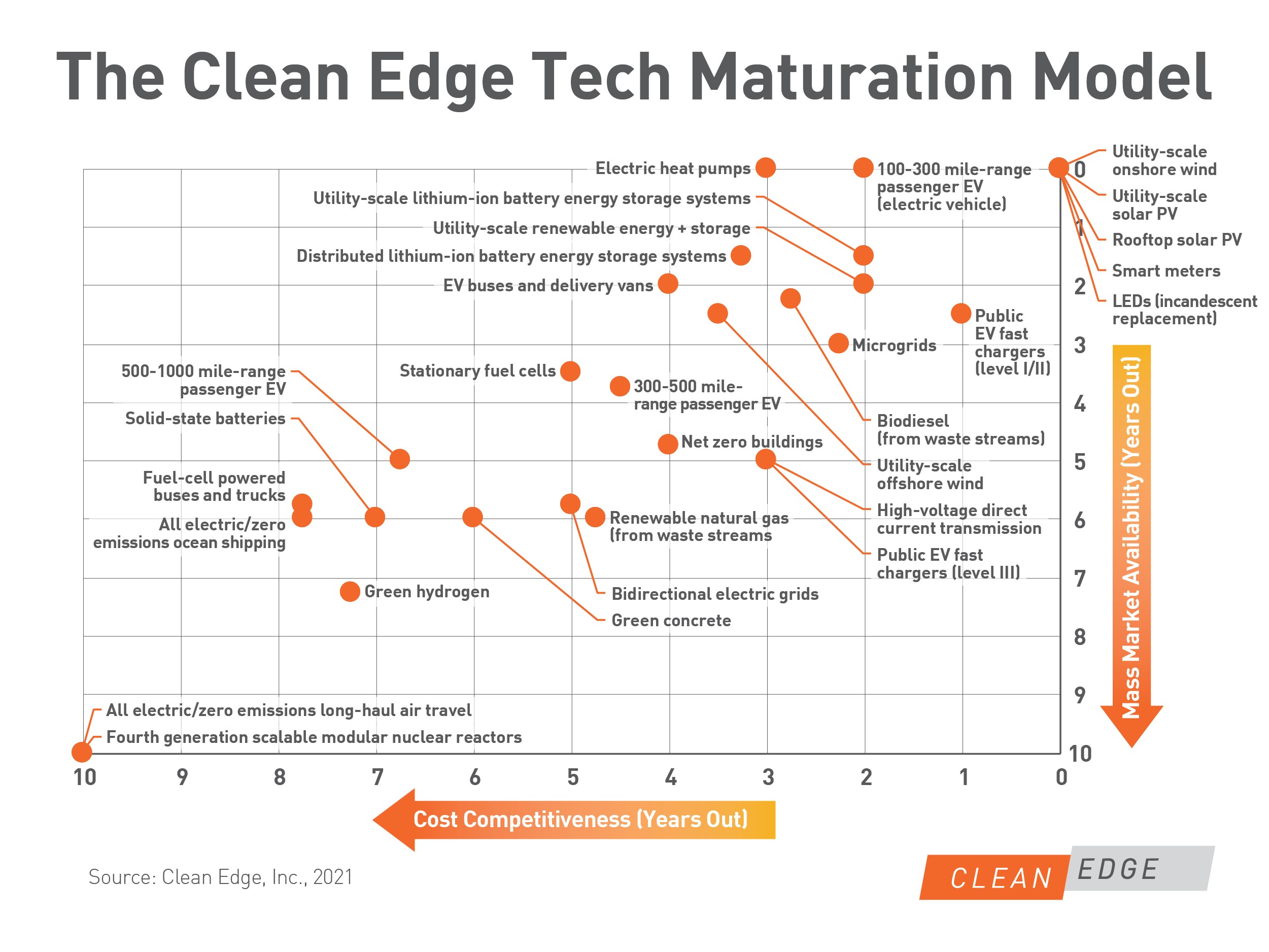

How can you predict which clean technology will reach maturation point first?

Well, Clean Edge1 have plotted the expected mass-market availability and the cost competitiveness across a host of clean technologies.

Source: Clean Edge, 2021

Take Green Hydrogen. Clean Edge forecast it to be roughly seven years away from both cost competitiveness and mass-market availability. But could a combination of the policy tailwinds and innovation-driven improvement in economics, quicken this?

The proposed landmark $550bn Infrastructure Bill in the United States assigns $9.5bn to the hydrogen sector, spelling out an aim to reduce costs and create a coherent national strategy for wide-scale production, processing, delivery and storage of clean hydrogen. Whisper it quietly, but this could be positive news for early investors into the green hydrogen story.

Elsewhere, the Bill will allocate $7.5 billion to expand electric vehicle charging to under-serviced areas (almost double all prior public investment by utilities, states AND the government). It also represents the first-ever national investment in Electric Vehicle (EV) charging infrastructure in the US. With EV sales hitting records and forecasts of nearly 70% of the total car market to be plug-in cars 20402 - more charging infrastructure is badly needed.

The same Bill aims to make cities more climate-resilient by retrofitting over 2 million homes and offices, while also cutting building pollution. Buildings too have a major part to play in supporting the transition to a low-carbon economy. The emissions which buildings produce account for a large portion of the global footprint (think lighting, heating, cooling). In another article we take a closer look at a company which is offering net zero buildings as a service.

Finally, who knows what the final Infrastructure Bill will look like if or indeed when it passes through the House. But, to be clear, Clean Edge published its model a full two months before the first Bill had even passed through the Senate.

1 *Clean Edge are a world leading expert and the original sell side research firm in clean technology.

2 Source: Bloomberg NEF, 2021

Important Information

This financial promotion is issued by First Trust Global Portfolios Management Limited (“FTGPM”) of Fitzwilliam Hall, Fitzwilliam Place, Dublin 2, D02 T292. FTGPM is authorised and regulated by the Central Bank of Ireland (“CBI”) (C185737). The Fund is also regulated by the CBI. Nothing contained herein constitutes investment, legal, tax or other advice and it is not to be solely relied on in making an investment or other decision, nor does the document implicitly or explicitly recommend or suggest an investment strategy, reach conclusions in relation to an investment strategy for the reader, or provide any opinions as to the present or future value or price of any fund. It is not an invitation, offer, or solicitation to engage in any investment activity, including making an investment in a Fund, nor does the information, recommendations or opinions expressed herein constitute an offer for sale of a Fund.

Share