“The case for digital transformation has never been more urgent or clearer. Digital technology is a deflationary force in an inflationary economy.”

Satya Nadella

Key takeaways

- Inflation is back and at the highest it’s been in 40 years.

- Could it be time to position digital technology as the solution for companies to help compensate for price increases?

- We ask if productivity can protect investors against inflation? The good news: companies are investing again.

With inflation back and at the highest it’s been in 40 years, Satya Nadella used Microsoft’s latest earnings call to position digital tech as the solution for companies aiming to mitigate upcoming price increases.

This argument isn’t new. Tech innovation is widely known to be one of the best ways for companies to reduce costs and improve productivity.

In March 2020, Edward Yardeni positioned ‘Disruption’ as one of the four deflationary forces keeping a lid on inflation (the other three were Détente, Demography, and Debt). Yardeni highlighted that the impact of technology on the economy had not been given enough attention adding, “technology is inherently disruptive and deflationary since there is a tremendous incentive to use it to lower costs across a wide range of businesses.”1

With inflation levels at a 40 year high, digital tech and its associated productivity gains could take on much more prominence in the second half of 2022, and beyond.

In 2020 and 2021 cloud computing exploded as companies went digital in response to the pandemic. Although pre-Covid, the cloud transition was already underway, the pandemic was the accelerant, with 70% of organisations increasing their cloud spending in the wake of Covid-19. And in 2022, this trend has continued. Amazon, Google and Microsoft, the three largest public cloud infrastructure service providers, exceeded expectations in Q1. Amazon’s AWS, grew its top line by 37% YoY, raking in a total of $18.4bn in sales. With that, Amazon made a whopping $67bn in 12-month recurring sales through this segment. Elsewhere, Google’s Cloud reported strong numbers with growth topping 44% YoY and sales totalling $5.8bn for the quarter, and Microsoft’s Azure grew its top line by 46% YoY. Companies are seeing cloud computing as a business essential. According to Gartner’s latest forecast, global spending on cloud services is expected to reach over $600 billion in 2023, up from $410 billion in 20212.

What does this mean for thematic investors? Those companies at the forefront of the cloud computing industry have become vital to today’s economy, effectively becoming digital utilities. This means it will remain a key area of investment for the majority of companies, with the latest data from Gartner also showing that by 2024 the average company aspires to have cloud spend represent 80% of its total IT-hosting budget3. We may see this accelerate even further in an inflationary environment, as companies look to invest in digital technology to offset higher costs and boost productivity.

During Microsoft’s earnings call, Nadella was asked about how digitalisation is helping businesses to compensate for price increases. He said: “In an inflationary environment, the first place any business should go to is how to really ensure that they’re able to get productivity gains. And even dealing with constraints, for example, if you have supply chain constraints, one of the things you want to do is run your factories at the efficient frontier.” This concept is an interesting one – that companies need to be driven as far as possible in the name of efficiency. Companies can really unlock cloud’s potential. Given cloud’s speed, scale, innovation and productivity accelerative qualities it can help reduce costs, drive efficiency and potentially even transform business operations. To this end, McKinsey recently projected that cloud adoption could potentially drive $1.8 trillion in business value by 20254.

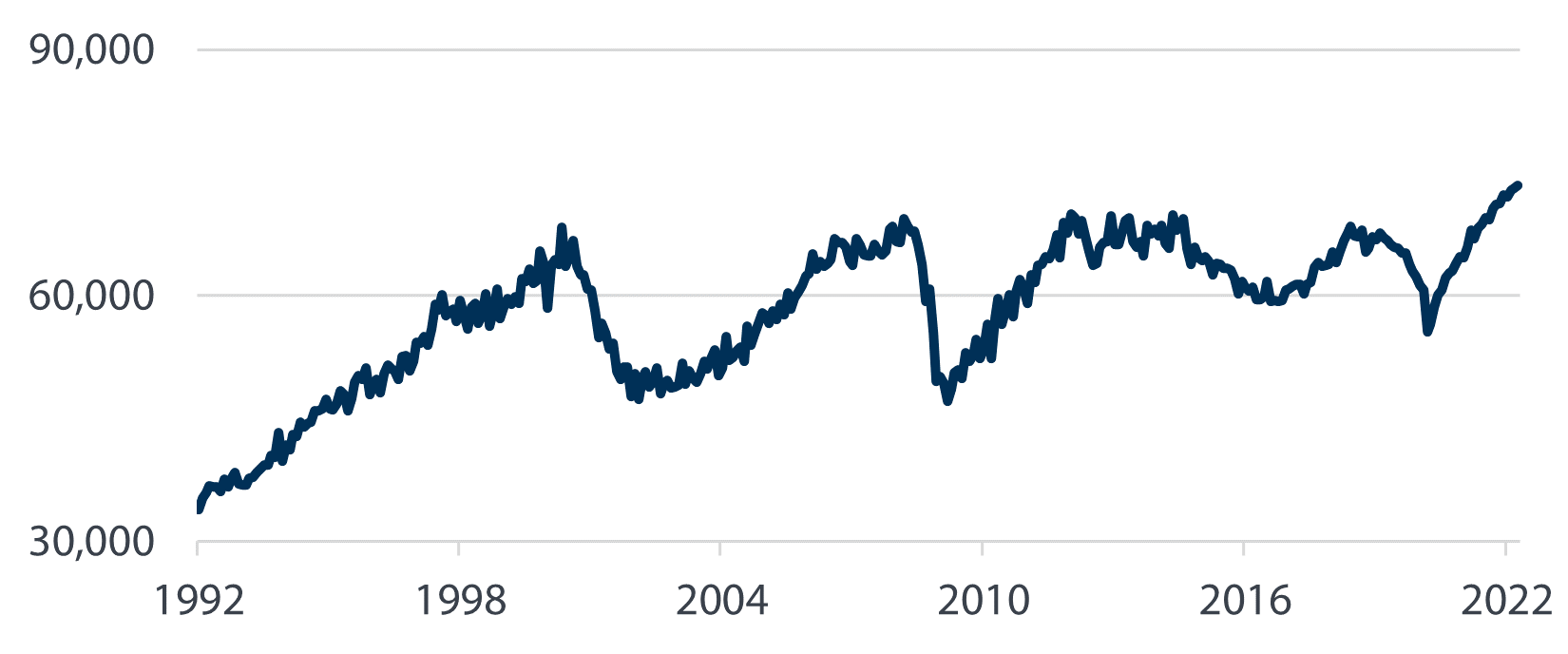

Can this increased productivity protect investors against inflation? Here’s the good news: companies are investing again. And an uptick in higher capital expenditure should correspond to a boost in productivity. As the chart below highlights, Manufacturers’ new orders (ex. Aircraft and military spending) reached the highest figure on record last month (not adjusted for inflation).

Share