When the world went into Covid shock during the first quarter of 2021, change was everywhere.

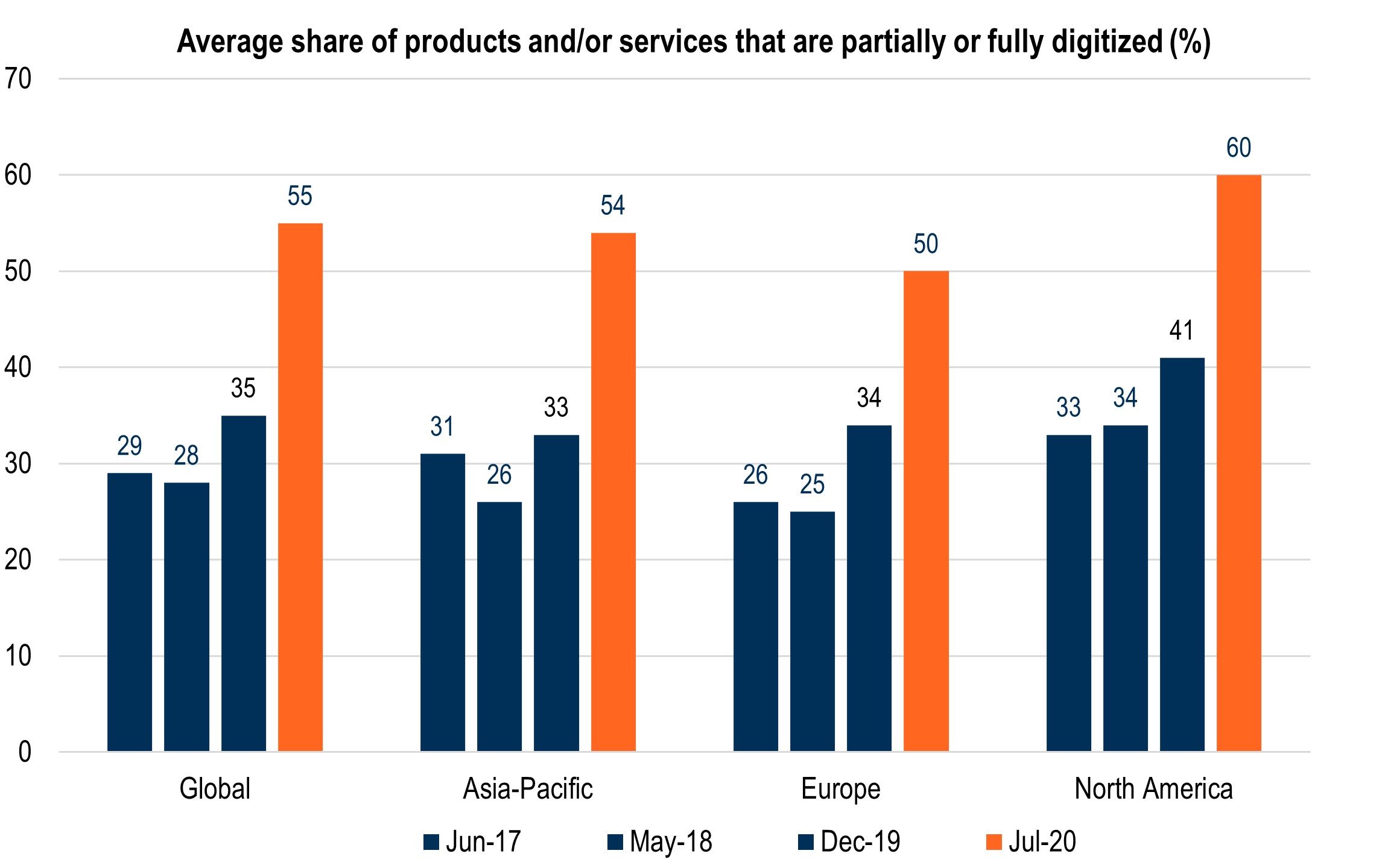

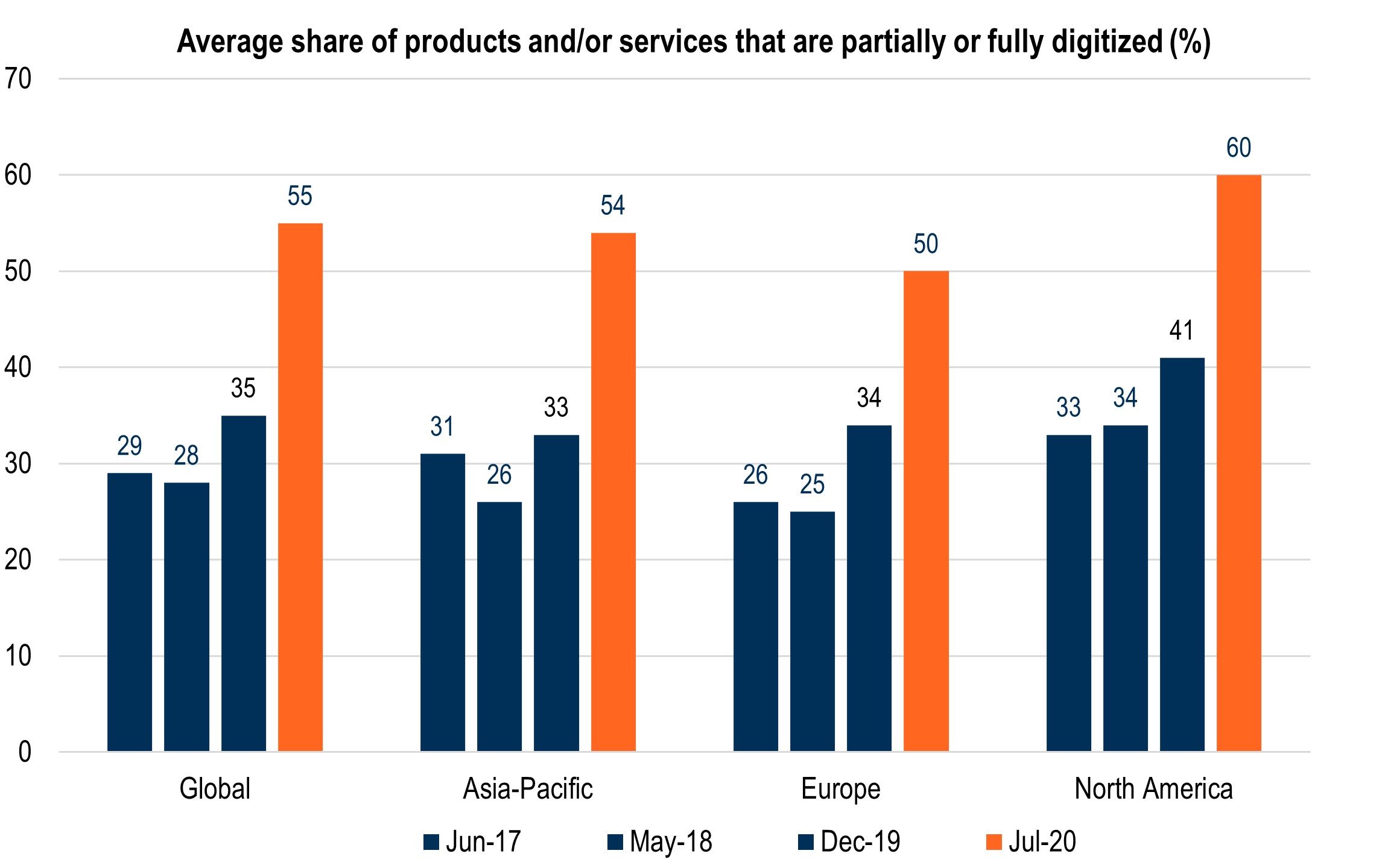

With shops closed and lockdowns abound, e-commerce boomed. For a meeting to happen, it had to take place online. In these critical months, global digital adoption had accelerated by seven years, according to McKinsey [1].

That certain companies (like Amazon or Zoom) saw a huge upswing in their business was hardly surprising. But throughout, people questioned how much of this change would stick. If growth had been event-driven, surely it would taper once shops reopened and colleagues were free to meet over coffee?

Only, growth had not tapered. Reopening, however piecemeal, hasn’t slowed down companies tapping into the digital economy.

Mega-trends vs short-lived hype

Here is when the concept of Mega-trends becomes useful. The hallmarks of a mega-trend are, it does well even when times are bad, and does even better when times are good.

The digitization of products and services - enabled by data and technology - is a mega-trend. It’s a tectonic economic shift, which neither started with covid, nor is about to blow over.

Because mega-trends are so appealing to investors, company bosses have every incentive to pitch their work as the next big thing. Observe, for example, Mark Zuckerberg, who recently announced an embodied Internet – the Metaverse – will be the next big platform[2].

But his foresight is just as good as, say, Steve Ballmer’s, who – as Microsoft’s CEO – said in 2007[3]:

“There's no chance that the iPhone is going to get any significant market share. No chance.”

Or Steve Jobs, who said, in 2003:

“There are no plans to make a tablet. It turns out people want keyboards... we look at the tablet, and we think it is going to fail.”

As these quotes show, even those at the core of the technology revolution can’t forecast success. However well-informed, their judgment is just as clouded by their own biases and beliefs.

With mega-trends, trying to predict any specific technological outcome is a doomed effort. For investors hoping to capitalise on sweeping changes, a few limited bets are unlikely to deliver exceptional returns.

Instead, a better way to tap into mega-trends is a more structured, impassionate approach.

How thematic investing helps tap into mega-trends

Active investing may tap into mega-trends – but leaves investors at risk of portfolio managers beholden to storytelling fallacies, like those causing leading technologists to get it wrong (“Two years from now, spam will be solved” -Bill Gates, 2004).

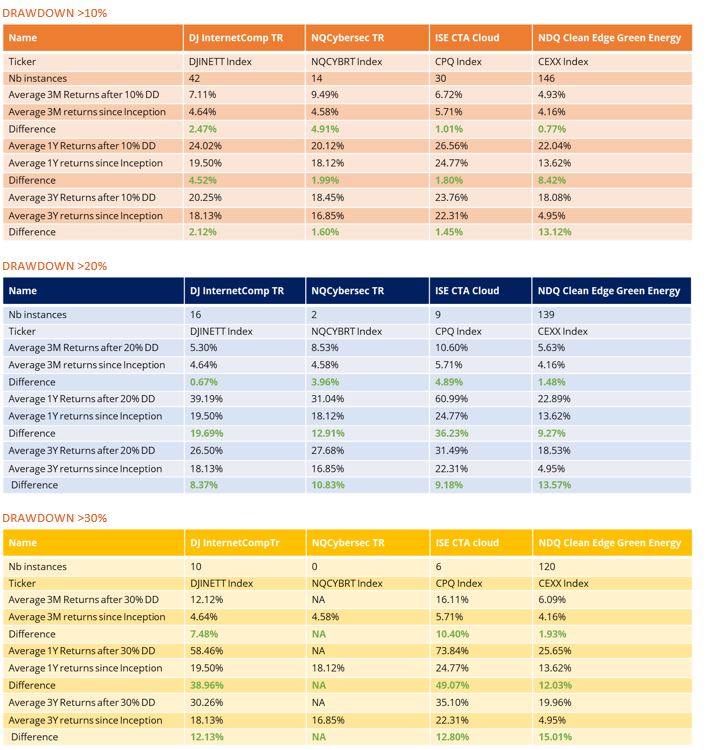

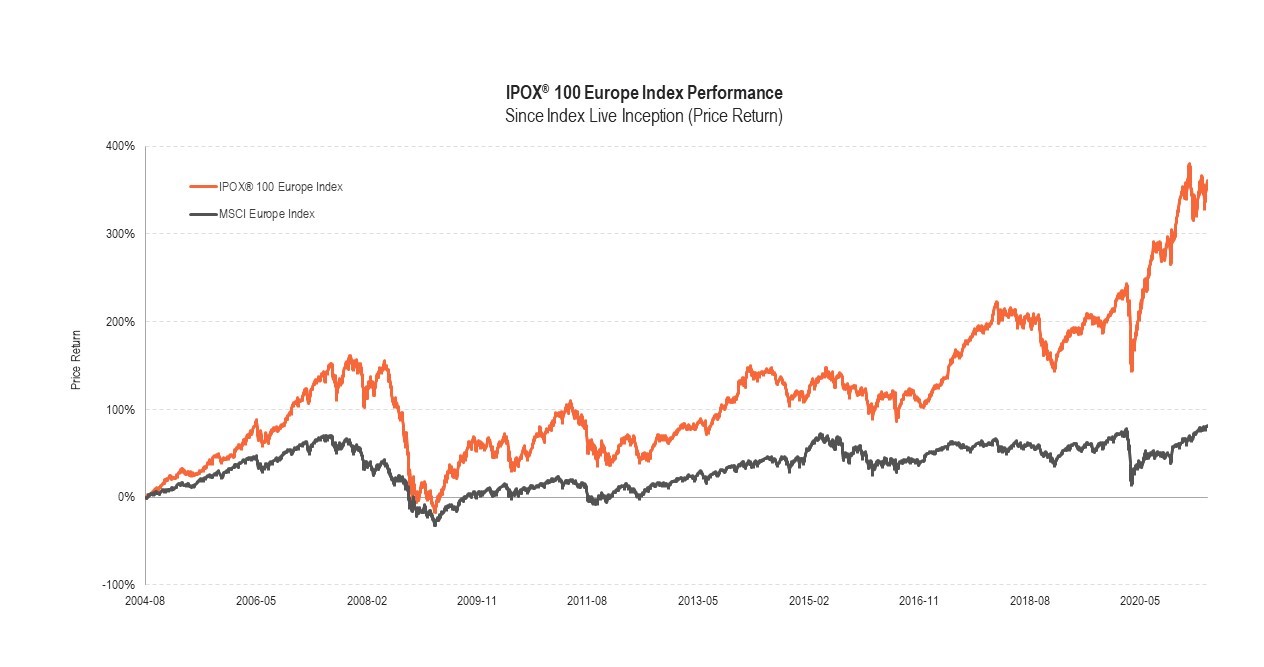

But thematic investing enables investors to better express their true investment beliefs. This form of investing removes emotions, breaks sector and geographical boundaries. It emboldens investors to buy into companies they wouldn’t have necessarily known about – and to stay invested, so long as it meets the thematic investment philosophy.

This form of rules-based investing allows an investor to be broader, while also being more precise, by providing more companies per theme than simply picking a handful of stocks across a number of themes.

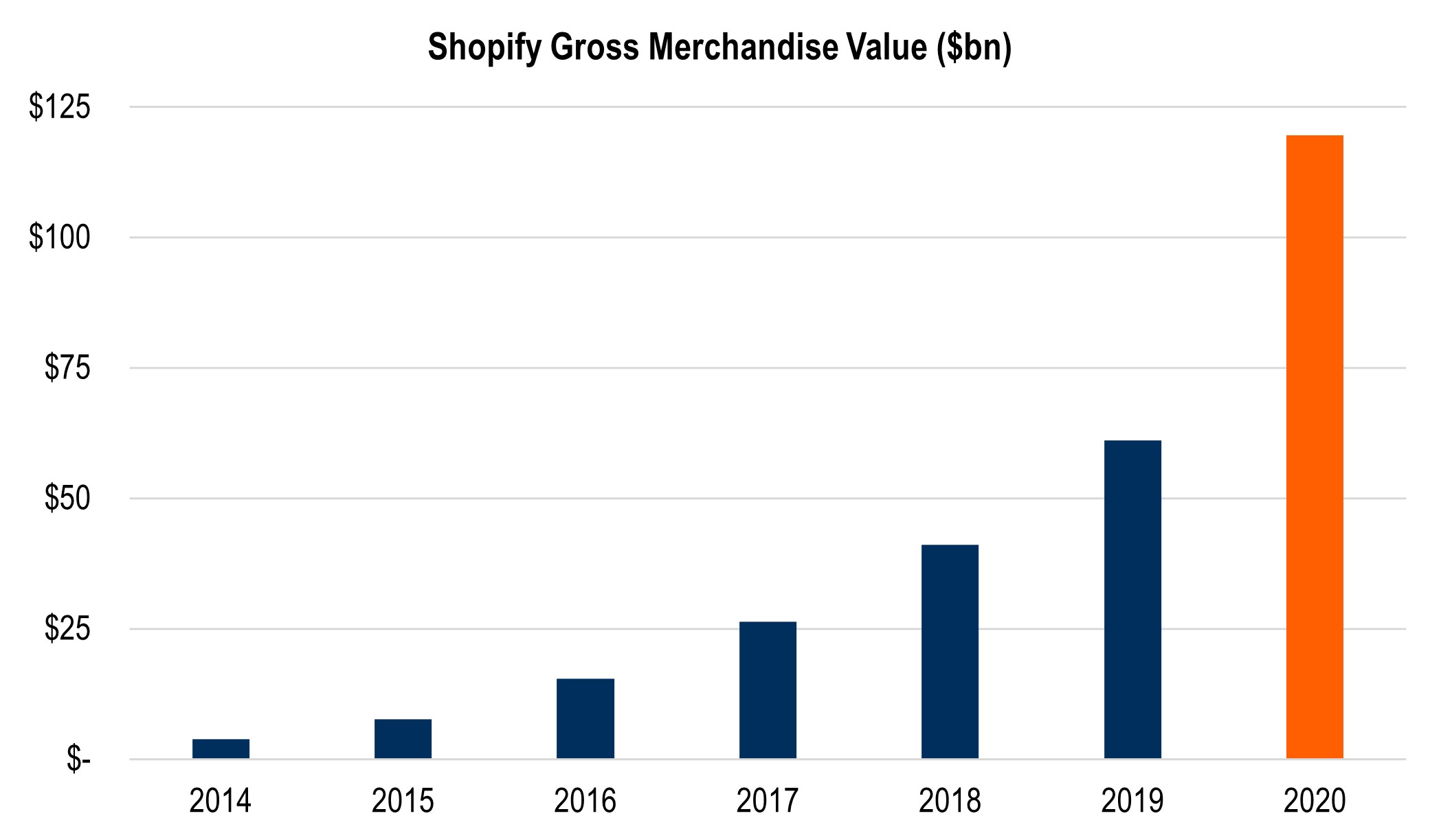

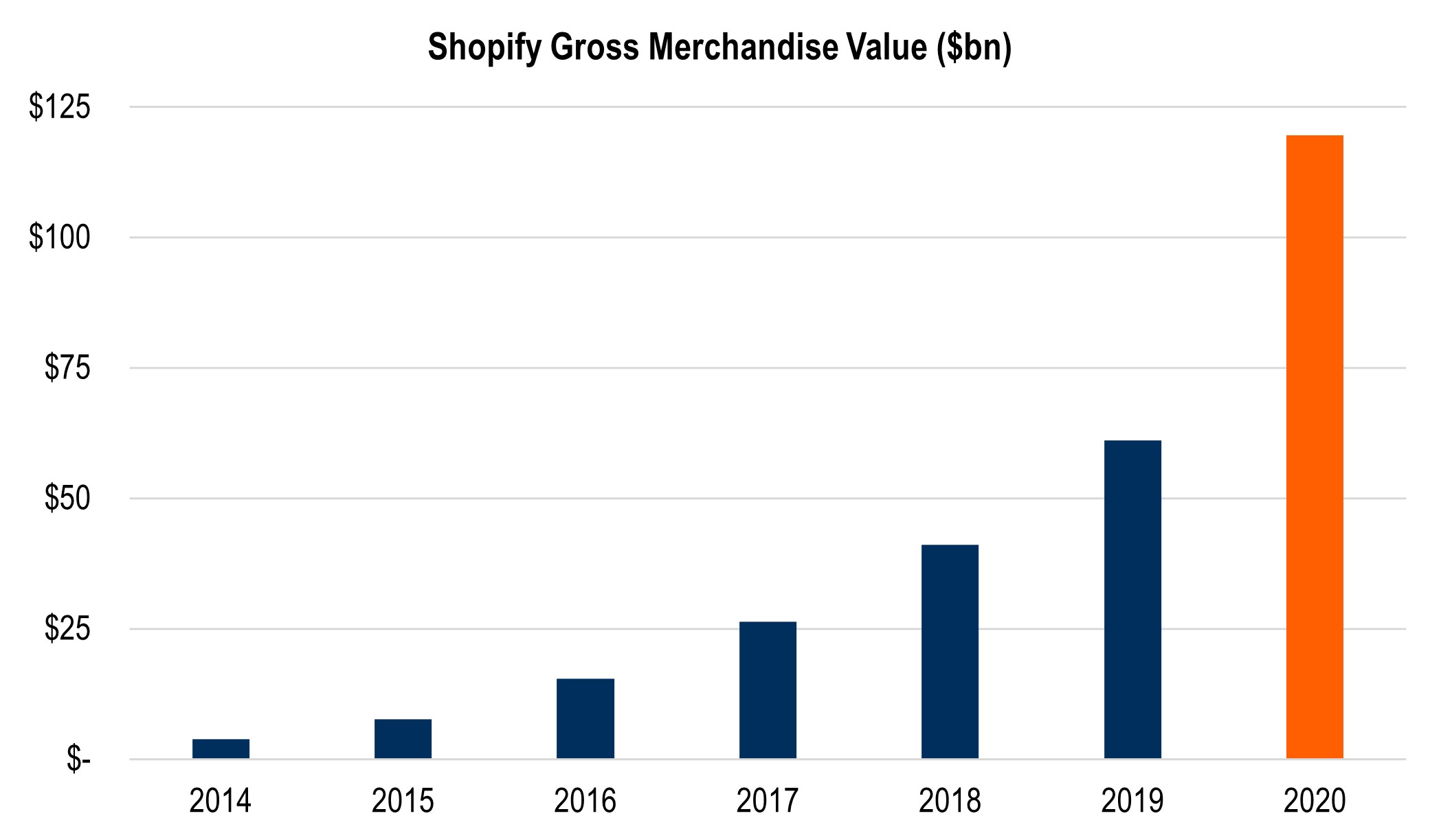

For example, most investors equate ‘ecommerce giant’ with ‘Amazon’. Meanwhile, a quiet alternative ecommerce behemoth has emerged out of Canada: Shopify.

Figure 1 Shopify GMV.

Source: Benedict Evans, 2021. The Great Unbundling. Data: Shopify (link: https://www.ben-evans.com/presentations)

Its logistics and commerce model differs to Amazon’s, allowing brands to go direct to consumers and own the customer relationship. Its growth has been stellar, and its proposition appeals to large brands worrying about counterfeits and commoditisation on Amazon’s platform. It may very well be that Shopify - not Amazon - is tomorrow’s shopping mall[4].

The Amazon-Shopify contrast exemplifies the benefits of thematic, rule-based investing:

For retail investors, purchasing many individual promising contenders and managing their holdings is time consuming and potentially expensive. Even with reduced trading costs, timing markets is a notoriously efficient way to lose money[5].

For professional investors, relying on a portfolio manager’s judgement not only exposes them to biases (as discussed above), but also to capped growth: many active managers will seek to de-risk a concentrated portfolio by maintaining a majority of dependable stocks, whose upside is fully priced-in.

Consider, for example, Etsy, which represents yet another alternative model to ecommerce. Its weighting in the S&P500 is a mere 0.1%. But its sales growth over Q1 2021 has been 141%, compared with the S&P 500’s 21.9%[6].

Most investors, professional or retail, may shy away from lesser-known companies delivering new innovation. But the discipline of rule-based thematic investing, leads to a broader, more inclusive universe.

References

[1] McKinsey, 2020. How COVID-19 has pushed companies over the technology tipping point—and transformed business forever. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

[2] BBC, 2021. Zuckerberg wants Facebook to become online ‘metaverse’. https://www.bbc.co.uk/news/technology-57942909

[3] Techspot, 2020. In Hindsight... Infamous Tech Predictions and Quotes. https://www.techspot.com/article/754-tech-predictions-and-quotes/

[4] Benedict Evans, 2021. Shopify. https://www.ben-evans.com/benedictevans/2021/2/17/shopify

[5] Investopedia, 2019. Market Timing Fails As a Money Maker. https://www.investopedia.com/articles/trading/07/market_timing.asp

[6] Source: FactSet., as at 18th June 2021.

Past performance is no guarantee of future results. Total results refers to the full portfolio and benchmark holdings & returns. This report was prepared by FTGP and reflects the current opinions of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security or strategy. References to specific companies should not be construed as a recommendation to buy or sell shares or other financial instruments issued by those companies, and neither should they be assumed profitable.

Share